The Kalifa Review made fice (5) Recommendations in he following areas:

- Policy and Regulation

- Skills

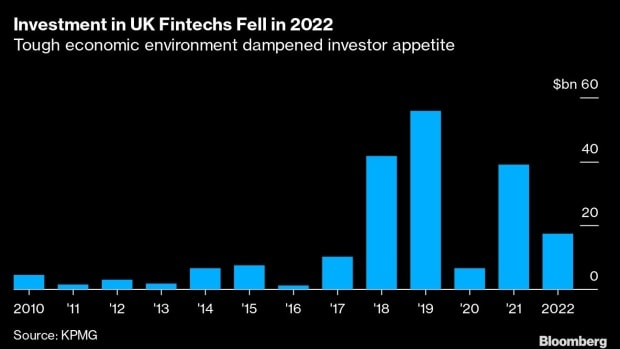

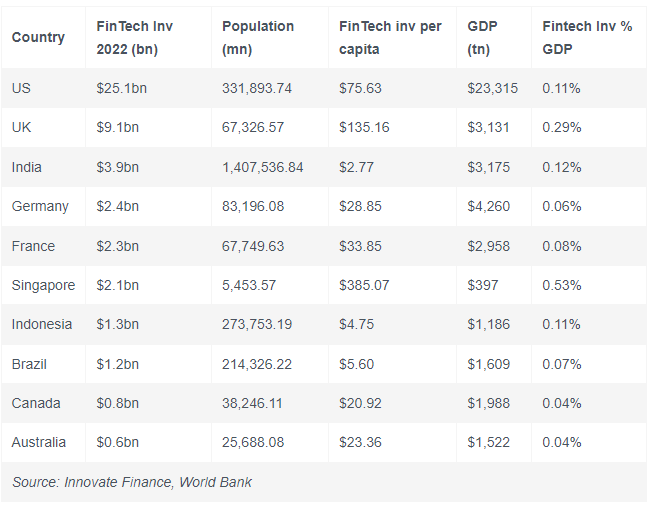

- Investment

- International

- National connectivity

- Policy and Regulation -

- Skills

- International

- Investment

- National connectivity

Read the Kalifa Review

Read Fnextra Article here