If you are crypto firm seeking regulatory advice or director services, please contact CompliReg for assistance at the details appearing here and check out its VASP registration and other authorisation services here.

Don't forget to sign up to our Newsletter (we don't spam) by clicking here. We use MailChimp, which means you can unsubscribe whenever you like.

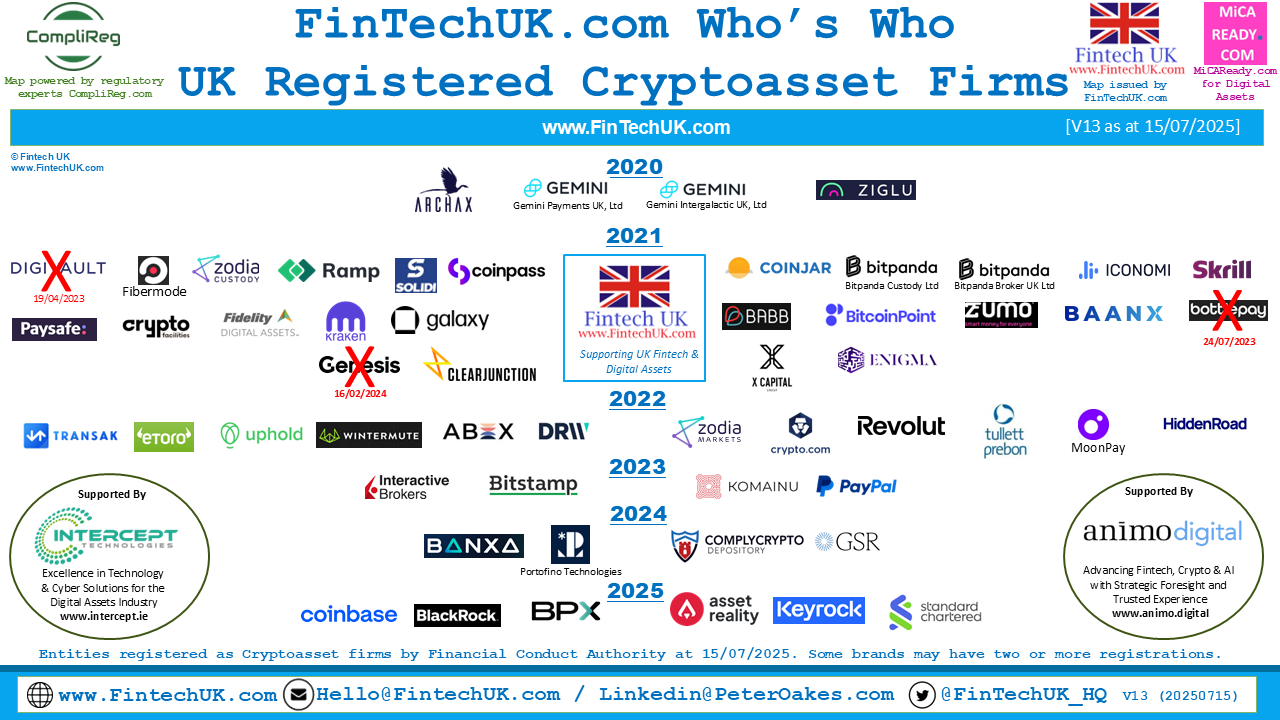

"There are now 52 registered Cryptoasset firms appearing on the Financial Conduct Authority's (FCA) website as at 15th July 2025."

This means that FINTECH UK has had to publish Version 13 of its UK Registered #CryptoAsset Firms Map just hours after publishing V12 based on close of business data of 14 July when Standard Chartered did not appear on the FCA register!

Thanks to our two new key supporters – Intercept Technologies (Joe McCann and Gabriele Mantellini) & Animo Digital (Nick Maybin, Mark Quirk, Tim Buckingham & Jamie Bixby) – both of which are active in supporting the UK & EU DigitalAssets Industries & the wider Fintech Ecosystems. We have suggested these two companies to several firms that have approached us for recommendations on cybersecurity and business strategy. We have been delighted to receive positive feedback on both Intercept Technologies and Animo Digital from inquirers.

They join CompliReg & MiCA Ready which continue to support the Map. Please get in touch with Intercept Technologies (https://www.intercept.ie), Animo.Digital (https://animo.digital), CompliReg (https://complireg.com) & MiCA Ready (https://micaready.com) via their websites & give them a follow on Linkedin.

Please get in touch with CompliReg, MiCAReady.com, Intercept Technologies and Animo.Digital via their websites and give them a follow on Linkedin at:

Standard Chartered Bank is now the 6th firm registered in 2025 by the UK FCA and the first one in H2 2025. Thes list of 2025 registrants thus far are:

* GSR Markets UK Limited – 31 December 2024

* CB Payments Ltd (aka Coinbase) – 03 February 2025

* BlackRock International, Limited – 01 April 2025

* BPX Digital Securities Marketplace – 29 May 2025

* Asset Reality Limited – 20 June 2025

* Keyrock UK Limited – 25 June 2025

* Standard Chartered Bank - 14 July 2025

“As client demand accelerates further, we want to offer clients a route to transact, trade and manage digital asset risk safely and efficiently within regulatory requirements,” said Bill Winters, the bank’s chief executive.

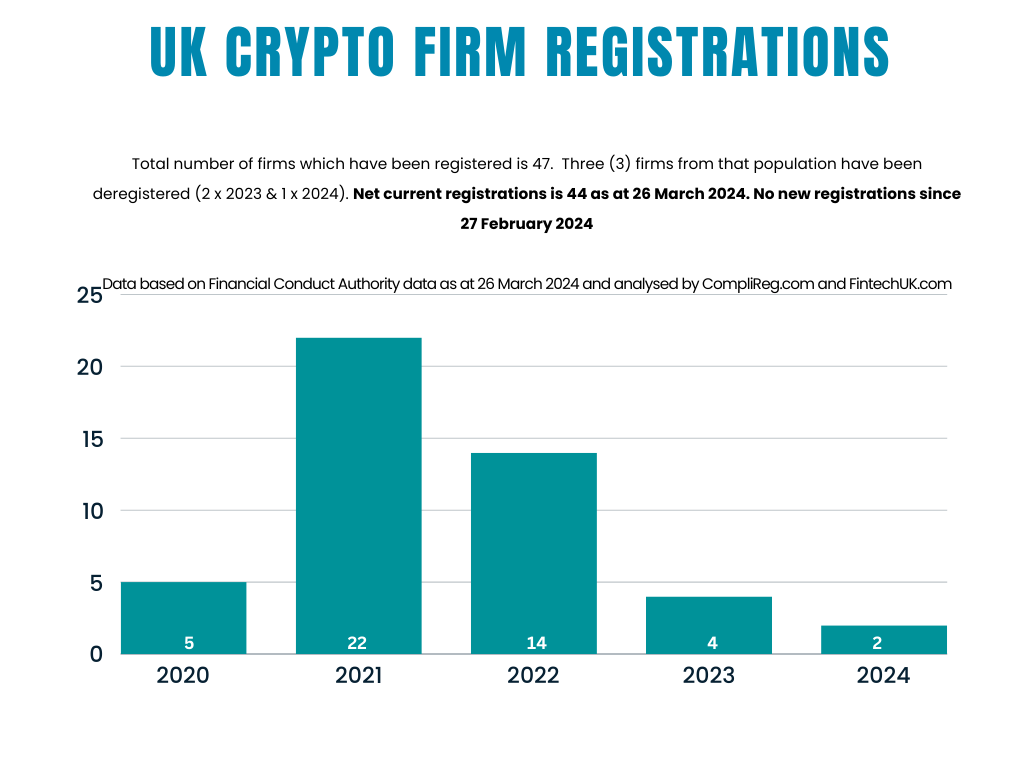

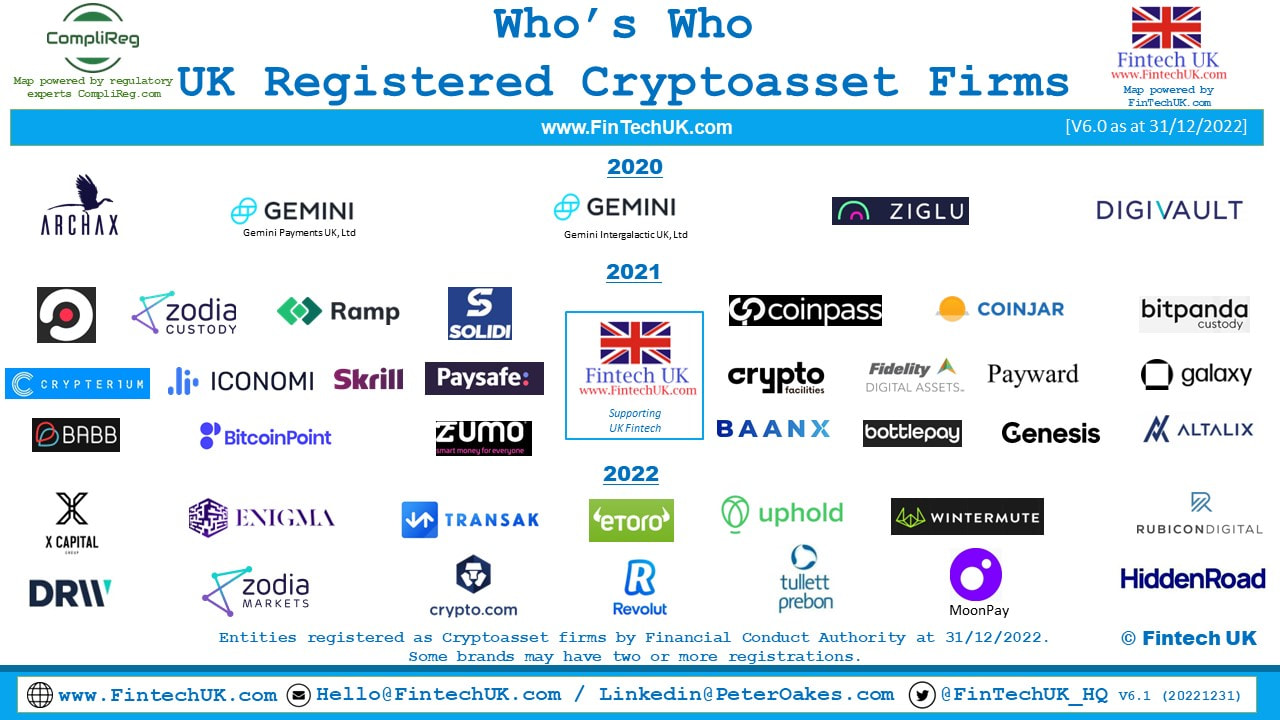

For those interested in the details, the number of registrations since 2020 until today are as follows:

- 2020 – 4 registrations

- 2021 - 25 registrations (3 firms registered in 2021 were subsequently deregistered)

- 2022 – 12 registrations

- 2023 – 4 registrations

- 2024 – 4 registrations (slightly confusing is that Gensis Custody is recorded as MLR registered in 2024, but it was registered in 2021. In any event, it is now de-registered)

- 2025 – 6 registrations

Total: 52 (55 less 3 de-registrations). These 52 UK FCA registered crypto firms are shown on our Map above.

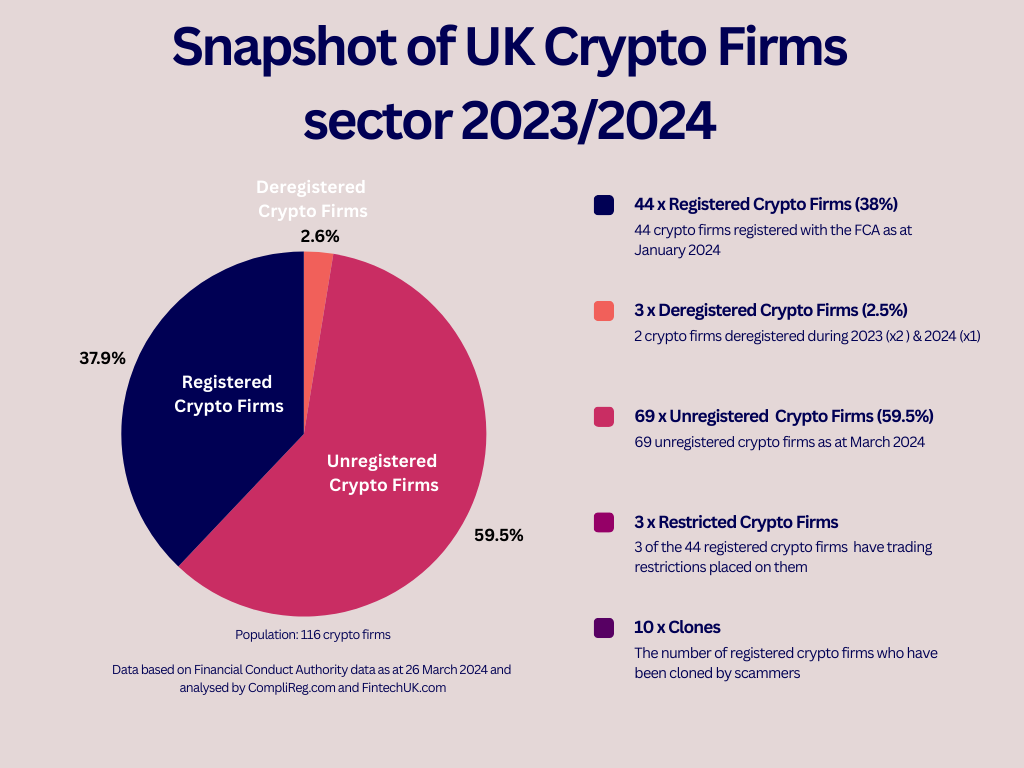

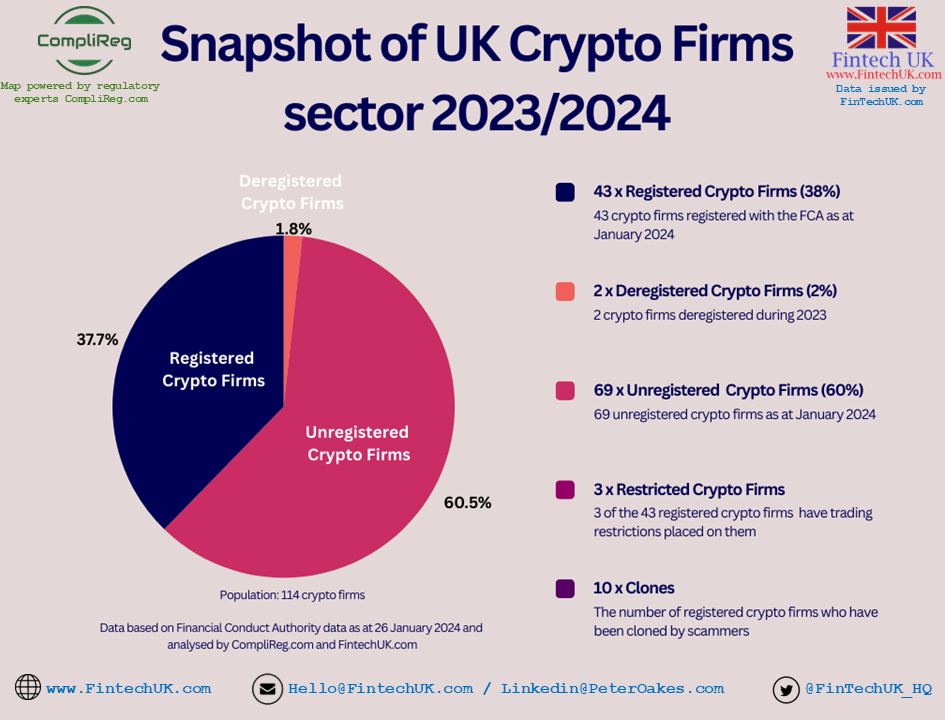

How many unregistered crypto firms appear on the FCA register?

There remains now 32 'unregistered cryptoasset business’ according to the then FCA records. Back on 24 October 2024 the number was 44 'unregistered cryptoasset business’. This is a decrease of 12 firms. However this is a net number. The most recent addition to the list of unregistered crypto firms in the UK is Orbis of DNS House, 382 Kenton Road, Harrow, Middlesex, HA3 8DP, UNITED KINGDOM (www.orbios.money) added on 19 March 2025. Yet still, overall, there appears to have been a sharp decline in the number of unregistered crypto asset firms since the publication of Version 9.0 Map when there were 69 such unregistered crypto firms.