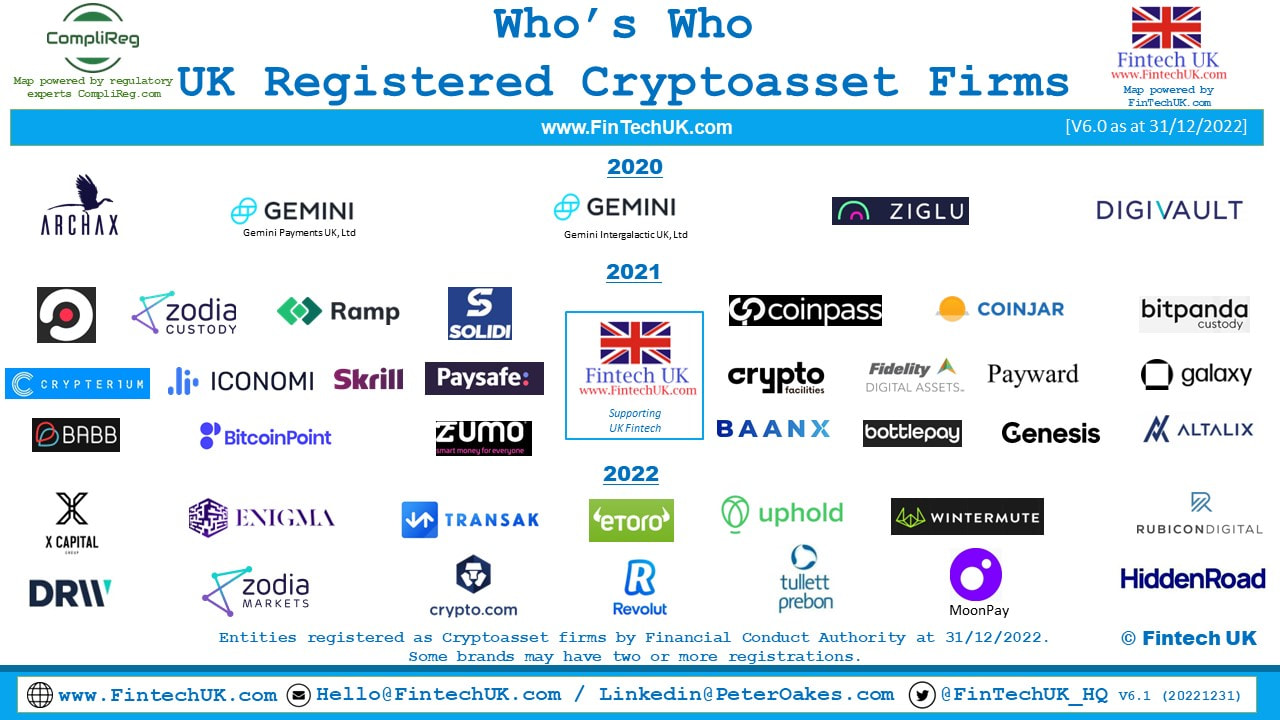

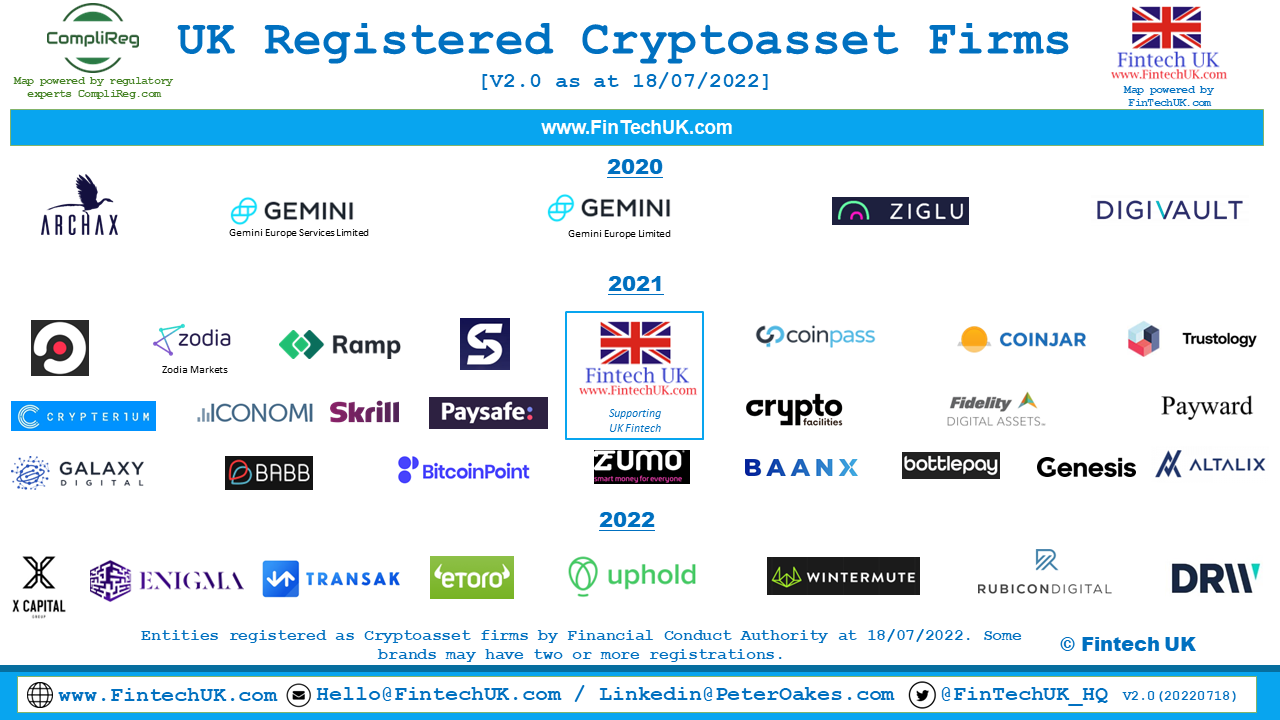

What will be the impact on the 41 registered UK crypto asset firms?

In a new report, the cross-party Committee of MPs highlights that cryptocurrencies such as Bitcoin have no intrinsic value and serve no useful social purpose, while consuming large amounts of energy and being used by criminals in scams, fraud and money laundering.

- Read the full report (HTML)

- Read the full report (PDF)

- Read the report summary

- Find all publications related to this inquiry, including oral and written evidence

Unbacked cryptoassets – often called cryptocurrencies – are not supported by any underlying asset. They are the most prominent form of crypto, with Bitcoin and Ether alone accounting for two-thirds of all cryptoassets.

The Committee concludes that cryptocurrencies pose significant risks to consumers, given their price volatility and the risk of losses. Given retail trading in unbacked crypto more closely resembles gambling than a financial service, the MPs call on the Government to regulate it as such.

The Committee is also concerned that regulating consumer crypto trading as a financial service – as proposed by the Government – will create a ‘halo’ effect, leading consumers to believe this activity is safe and protected, when it is not.

Around 10 per cent of UK adults hold or have held cryptoassets, according to HM Revenue & Customs.

The MPs recognise that technologies underlying cryptoassets may bring benefits to financial services, particularly for cross-border transactions and payments in less developed countries, and call on the Government and regulators to keep pace with developments so potentially productive innovations are not unduly constrained.

Given the future benefits of crypto remain unclear, the Government should take a balanced approach to supporting the development of cryptoasset technologies and avoid spending public resources on projects without a clear, beneficial use, as appears to have been the case with its now-abandoned Royal Mint non-fungible token (NFT). It is not the Government’s role to promote particular technological innovations for their own sake.

Chair comment

“The events of 2022 have highlighted the risks posed to consumers by the cryptoasset industry, large parts of which remain a wild west. Effective regulation is clearly needed to protect consumers from harm, as well as to support productive innovation in the UK’s financial services industry.

“However, with no intrinsic value, huge price volatility and no discernible social good, consumer trading of cryptocurrencies like Bitcoin more closely resembles gambling than a financial service, and should be regulated as such. By betting on these unbacked ‘tokens’, consumers should be aware that all their money could be lost.

The Committee is considering central bank digital currencies as a separate piece of work.

Summary of the report’s key conclusions and recommendations:

- It is important that the Government and regulators strive to keep pace with developments, including by ensuring that the Financial Conduct Authority's authorisations gateway is open and effective, so that potential productive innovation in financial services is not unduly constrained (Paragraph 31).

- While we support financial innovation where there are potential benefits, the extent of the benefits cryptoasset technologies may bring to financial services remains unclear. In the meantime, the risks posed by cryptoassets to consumers and the environment are real and present (Paragraph 36).

- We recommend that the Government takes a balanced approach to supporting the development of cryptoasset technologies. It should seek to avoid expending public resources on supporting cryptoasset activities without a clear, beneficial use case, as appears to have been the case with the Royal Mint NFT. It is not the Government’s role to promote particular technological innovations for their own sake (Paragraph 37).

- Regardless of the regulatory regime, their price volatility and absence of intrinsic value means that unbacked cryptoassets will inevitably pose significant risks to consumers. Furthermore, consumer speculation in unbacked cryptoassets more closely resembles gambling than it does a financial service. We are concerned that regulating retail trading and investment activity in unbacked cryptoassets as a financial service will create a ‘halo’ effect that leads consumers to believe that this activity is safer than it is, or protected when it is not (Paragraph 51).

- We strongly recommend that the Government regulates retail trading and investment activity in unbacked cryptoassets as gambling rather than as a financial service (Paragraph 52).