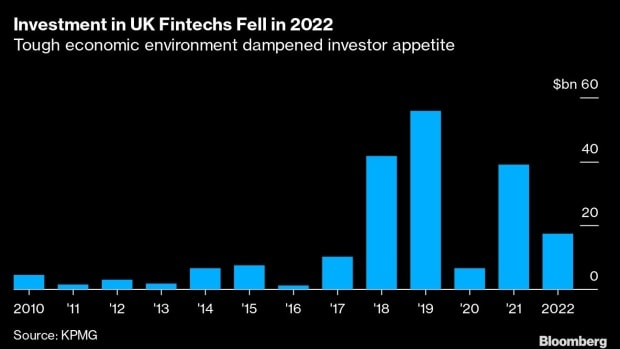

A total of 593 UK fintech deals were completed in the UK in 2022, down from 724 in 2021, according to KPMG’s Pulse of Fintech report published Wednesday. The dataset includes mergers and acquisitions, private equity, and venture capital.

Funding for the sector in 2022 was a tale of two halves according to Karim Haji, a partner at accountancy firm KPMG. The first half of the year saw significantly more investment and deals than the second half.

“The variance highlights the shift in investor sentiment in the face of increasing geopolitical challenges leading to the lack of IPO exits, the downward pressure on valuations, and market turbulence,” he said.

Global investment in crypto and blockchain firms fell from $30 billion in 2021 to $23.1 billion in 2022. Scrutiny in the space picked up as the price of digital assets slumped and the bankruptcy of FTX upended the market.

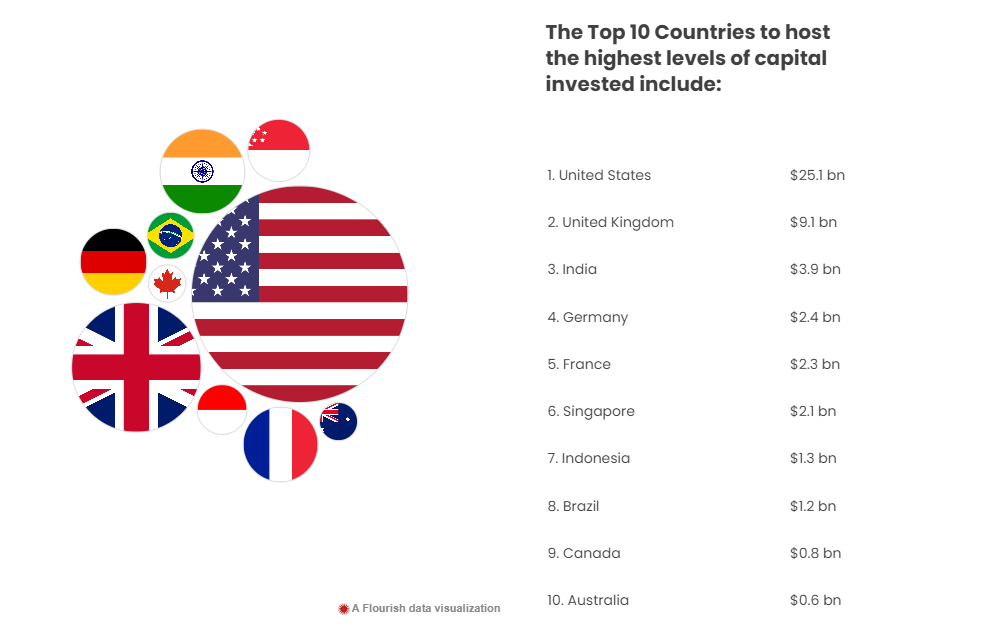

While British fintechs attracted more funding than their counterparts in the rest of EMEA combined, other fintech hubs are starting to catch up. The value of French fintech deals rose 28% to $3.7 billion last year, according to the KPMG analysis. Deals in Sweden, the home of Klarna, hit $3.7 billion, up from $2.6 billion.

UK startups and investors are increasingly expressing concern over recent government policies that appear to run counter to the country’s ambition of remaining a global fintech leader. They point to examples including the recent pulling of crucial funding to the government-backed industry body Tech Nation, the lack of visas to attract startup talent, and the removal of tax relief for research and development.

Worldwide, the fintech market attracted $164.1 billion across 6,006 deals in 2022. This was down from $238.9 billion across 7,321 deals a year earlier.

Source - https://www.bloomberg.com/news/articles/2023-02-15/uk-fintech-investment-plummeted-by-almost-60-in-2022-kpmg-says