“We could become a media [business] . . . a place where you have an audience and data about the audience and you monetise this,” Revolut’s head of growth.

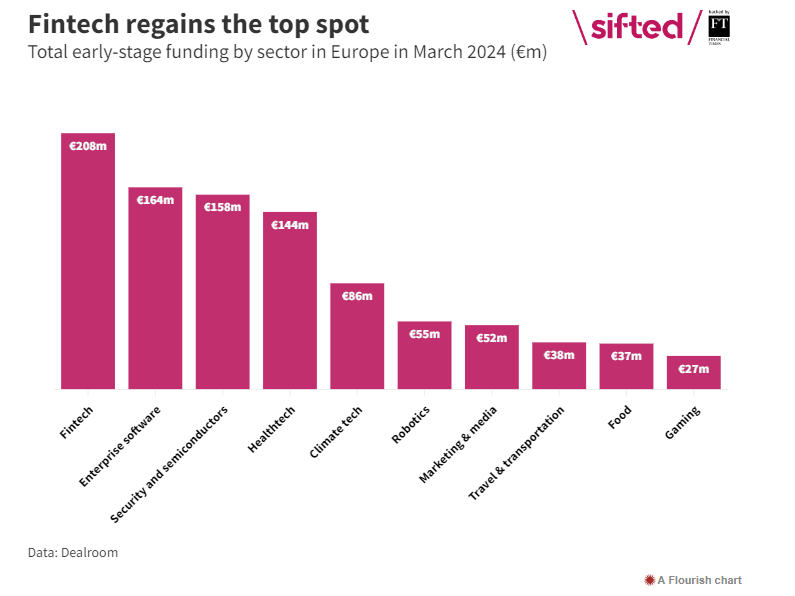

Revolut’s push to generate a bigger slice of earnings from advertising comes as investor hype surrounding the fintech sector has waned and its application for a UK banking licence appears to have stalled. Revolut secured a $33bn valuation in a funding round led by SoftBank in 2021. However, investors Molten Ventures and Schroders have since adjusted their implied internal valuations for the start-up, with Schroders putting it as low as $18bn at the end of 2022, before revising it up to $26bn as of the end of December 2023.

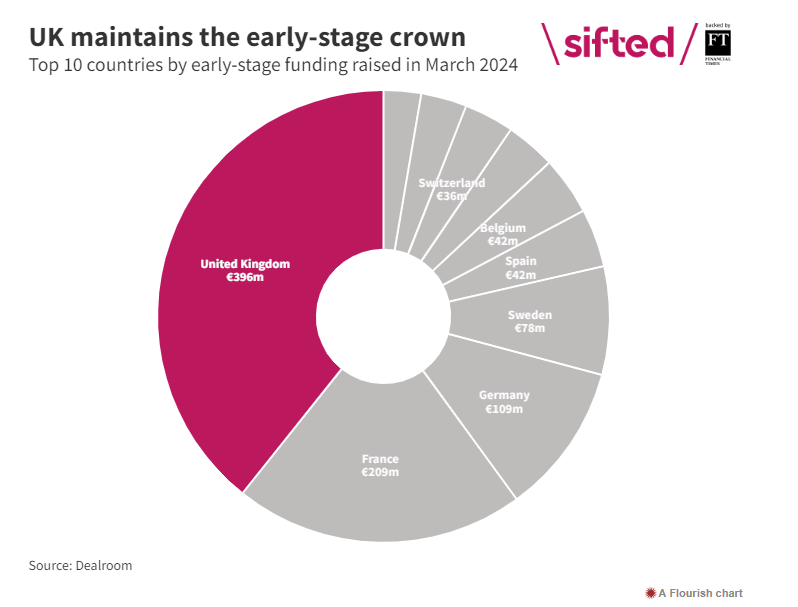

It has been more than three years since the London-based fintech applied for a UK banking licence. They are typically granted within a year, UK regulatory guidance says. Securing a licence is crucial to Revolut’s ambitions to roll out lending on a wider scale in its home market and boost its profitability.

https://www.ft.com/content/21c34ad2-c267-4810-a4bf-8908a3599d72