|

Get authorised/licensed in the UK as, or buy a licensed: UK digital bank; emoney/payments firm; investment services firm or a crypto-asset services provider. Don't waste time. Speak to the experts at CompliReg. It is the only independent firm led by a lawyer who has served in senior executive roles at the FCA (FSA), Central Bank of Ireland, ASIC and Saudi Central Bank. They get firms regulated in the EEA too, not just in the UK!

0 Comments

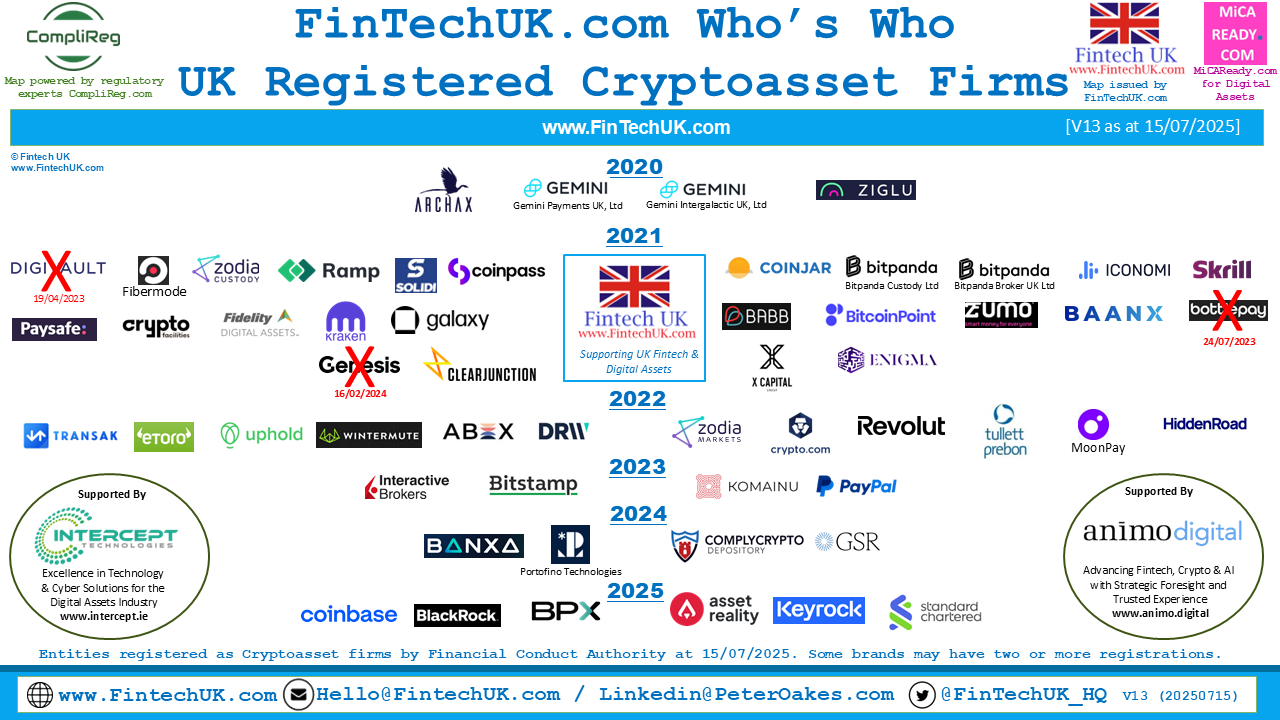

Fintech UK is looking to partner with registered / regulated (or soon to be) cryptoasset firms on building out a cryptoasset section on our website. If you are senior executive at a UK registered cryptoasset firm, please contact us here to discuss the proposed project. Also happy to hear from senior executives at businesses which support crypto firms to support the project. See our CRYPTO page for more information If you are crypto firm seeking regulatory advice or director services, please contact CompliReg for assistance at the details appearing here and check out its VASP registration and other authorisation services here. Don't forget to sign up to our Newsletter (we don't spam) by clicking here. We use MailChimp, which means you can unsubscribe whenever you like. "There are now 52 registered Cryptoasset firms appearing on the Financial Conduct Authority's (FCA) website as at 15th July 2025." Standard Chartered Bank has been registered by the UK Financial Conduct Authority as a cryptoasset services provider! The first bank to achieve that status in the UK. The bank was registered for crypto asset services on Monday 14 July 2025. Standard Chartered has now begun, today Tuesday 15 July, allowing institutional clients to directly trade bitcoin and ether, becoming the first major bank to enable spot cryptocurrency transactions. This means that FINTECH UK has had to publish Version 13 of its UK Registered #CryptoAsset Firms Map just hours after publishing V12 based on close of business data of 14 July when Standard Chartered did not appear on the FCA register! Special thanks to our two new key supporters – Intercept Technologies and Animo Digital – both who are active in supporting the UK and EU Digital Assets Industry and the wider Fintech Ecosystems. Thanks to our two new key supporters – Intercept Technologies (Joe McCann and Gabriele Mantellini) & Animo Digital (Nick Maybin, Mark Quirk, Tim Buckingham & Jamie Bixby) – both of which are active in supporting the UK & EU DigitalAssets Industries & the wider Fintech Ecosystems. We have suggested these two companies to several firms that have approached us for recommendations on cybersecurity and business strategy. We have been delighted to receive positive feedback on both Intercept Technologies and Animo Digital from inquirers. They join CompliReg & MiCA Ready which continue to support the Map. Please get in touch with Intercept Technologies (https://www.intercept.ie), Animo.Digital (https://animo.digital), CompliReg (https://complireg.com) & MiCA Ready (https://micaready.com) via their websites & give them a follow on Linkedin. Please get in touch with CompliReg, MiCAReady.com, Intercept Technologies and Animo.Digital via their websites and give them a follow on Linkedin at: How many registered cryptoasset firms are there in the UK? There are now 52 registered Cryptoasset firms appearing on the Financial Conduct Authority's (FCA) website as at 15th July 2025. This represents an increase of one firm since version 12.0 was issued just yesterday. Standard Chartered Bank is now the 6th firm registered in 2025 by the UK FCA and the first one in H2 2025. Thes list of 2025 registrants thus far are: * GSR Markets UK Limited – 31 December 2024 * CB Payments Ltd (aka Coinbase) – 03 February 2025 * BlackRock International, Limited – 01 April 2025 * BPX Digital Securities Marketplace – 29 May 2025 * Asset Reality Limited – 20 June 2025 * Keyrock UK Limited – 25 June 2025 * Standard Chartered Bank - 14 July 2025 “As client demand accelerates further, we want to offer clients a route to transact, trade and manage digital asset risk safely and efficiently within regulatory requirements,” said Bill Winters, the bank’s chief executive. Standard Chartered said today's move would give clients the reassurance of dealing with a regulated bank and help remove some of the barriers faced by institutions wanting to trade in the space. Crypto trading would take place through the same platforms its clients use for currency trading, it added, while clients could choose which custodian to settle their trades at. In 2020, the British bank backed crypto trading and custody business Zodia Markets through its ventures arm. How many firms have been registered and deregistered by the UK FCA?

For those interested in the details, the number of registrations since 2020 until today are as follows:

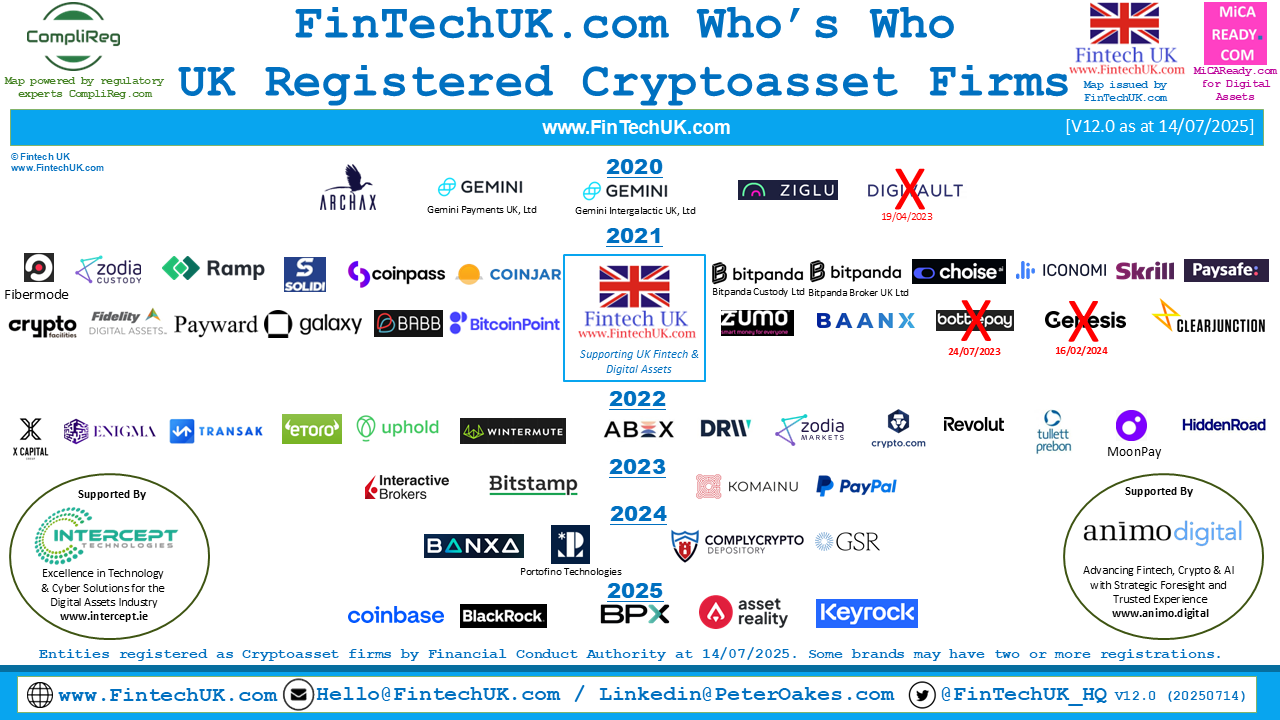

Total: 52 (55 less 3 de-registrations). These 52 UK FCA registered crypto firms are shown on our Map above. How many unregistered crypto firms appear on the FCA register? There remains now 32 'unregistered cryptoasset business’ according to the then FCA records. Back on 24 October 2024 the number was 44 'unregistered cryptoasset business’. This is a decrease of 12 firms. However this is a net number. The most recent addition to the list of unregistered crypto firms in the UK is Orbis of DNS House, 382 Kenton Road, Harrow, Middlesex, HA3 8DP, UNITED KINGDOM (www.orbios.money) added on 19 March 2025. Yet still, overall, there appears to have been a sharp decline in the number of unregistered crypto asset firms since the publication of Version 9.0 Map when there were 69 such unregistered crypto firms. "There are now 51 registered Cryptoasset firms appearing on the Financial Conduct Authority's (FCA) website as at 14th July 2025." Fintech UK is looking to partner with registered / regulated (or soon to be) cryptoasset firms on building out a cryptoasset section on our website. If you are senior executive at a UK registered cryptoasset firm, please contact us here to discuss the proposed project. Also happy to hear from senior executives at businesses which support crypto firms to support the project. See our CRYPTO page for more information If you are crypto firm seeking regulatory advice or director services, please contact CompliReg for assistance at the details appearing here and check out its VASP registration and other authorisation services here. Don't forget to sign up to our Newsletter (we don't spam) by clicking here. We use MailChimp, which means you can unsubscribe whenever you like. Welcome to version 12.0 of Fintech UK's and CompliReg's UK FCA registered Cryptoasset Firms Map. Special thanks to our two new key supporters – Intercept Technologies and Animo Digital – both who are active in supporting the UK and EU Digital Assets Industry and the wider Fintech Ecosystems. We have suggested these two companies to several firms that have approached us for recommendations on cybersecurity and business strategy. We have been delighted to receive positive feedback on both Intercept Technologies and Animo Digital from inquirers. We continue our partnership with MiCAReady.com which assist digital asset firms meet the requirements under the MICA Regulation. Please get in touch with CompliReg, MiCAReady.com, Intercept Technologies and Animo.Digital via their websites and give them a follow on Linkedin at: How many registered cryptoasset firms are there in the UK? There are now 51 registered Cryptoasset firms appearing on the Financial Conduct Authority's (FCA) website as at 14th July 2025. This represents an increase in numbers since version 11.0 was issued on towards the end of 2024. Version 12 of the Map welcomes the entry of the following six digital asset firms, registered by the UK Financial Conduct Authority:

How many firms have been registered and deregistered by the UK FCA? For those interested in the details, the number of registrations since 2020 until today are as follows:

Total: 51 (54 less 3 de-registrations). These 51 UK FCA registered crypto firms are shown on our Map. "The most recent addition to the list of unregistered crypto firms in the UK is Orbis (www.orbios.money) added on 19 March 2025" How many unregistered crypto firms appear on the FCA register? There remains now 32 'unregistered cryptoasset business’ according to the then FCA records. Back on 24 October 2024 the number was 44 'unregistered cryptoasset business’. This is a decrease of 12 firms. However this is a net number. The most recent addition to the list of unregistered crypto firms in the UK is Orbis of DNS House, 382 Kenton Road, Harrow, Middlesex, HA3 8DP, UNITED KINGDOM (www.orbios.money) added on 19 March 2025. Yet still, overall, there appears to have been a sharp decline in the number of unregistered crypto asset firms since the publication of Version 9.0 Map when there were 69 such unregistered crypto firms. GSR Markets: The newly granted FCA registration enables GSR Markets UK Limited to facilitate over-the-counter (OTC) and programmatic execution crypto asset trading services for clients, including in the United Kingdom. This approval underscores GSR’s dedication to adhering to the highest regulatory standards and delivering reliable, secure, and efficient trading solutions to clients. “Receiving FCA approval marks a significant milestone in our mission to shape a more transparent, inclusive global crypto trading ecosystem,” said Xin Song, Group CEO, GSR. “By achieving approvals from two of the world’s leading financial regulators, the GSR Group can confidently expand our services to institutional and professional clients globally while continuing to uphold the integrity and high-quality service that we are known for.” “With crypto markets performing strongly and Bitcoin reaching all-time highs, this achievement comes at an opportune time,” added Jakob Palmstierna, CEO, GSR Markets UK Limited and President, GSR Group. “Demand for reliable, regulated trading solutions has never been greater and this new registration allows us to further support clients as they navigate the dynamic, rapidly growing market.” Source: https://www.businesswire.com/news/home/20250106959007/en/GSR-Achieves-UK-FCA-Approval-Solidifying-Leadership-in-Global-Crypto-Markets CB Payments: This is a critical registration to cement our strong position in the UK and unlock our ambitious expansion plans. Our mission is to onboard the next 1 billion people into crypto while prioritising security for customer assets and maintaining the highest standards of compliance. Coinbase’s core thesis is that greater adoption and use of cryptocurrencies will increase economic freedom, and achieving our VASP in the UK furthers this belief. https://www.coinbase.com/en-gb/blog/-Coinbase-Obtains-VASP-Registration-in-the-United-Kingdom Blackrock International: World-leading asset management firm BlackRock has received the green light from the U.K.’s Financial Conduct Authority (FCA) to offer crypto asset services and products. https://www.ccn.com/news/crypto/blackrock-uk-fca-crypto-asset-firm/ Asset Reality Limited: “Practitioners have always struggled with disjointed tools - managing spreadsheets, selecting wallets and exchanges, sourcing technical specialists and valuers, and navigating complex court processes without dedicated support,” said Aidan Larkin, co-founder and CEO of Asset Reality. “We’ve brought all that together in one purpose-built Platform for the first time, making seized asset management smarter, safer, and more accountable. This makes the Asset Reality Platform the first and only asset recovery operating system purpose-built by experienced practitioners for court-ordered asset recovery." https://www.assetreality.com/posts/fca-approves-asset-reality-to-offer-crypto-custody-services-in-the-uk KeyRock: Bradley Howell, UK Managing Director, states: “London is one of the world’s most influential financial hubs, and the FCA’s regulatory framework offers the structure needed for responsible market growth. Expanding Keyrock’s presence in the UK is a strategic step to address rising demand for trading solutions in a market that is central to the future of digital assets.” https://keyrock.com/keyrock-achieves-fca-registration/ As we continue to Map registered Cryptoasset firms, expect to see certain logos appear more than once as several brands will be registering several Cryptoasset firms for different purposes, such as - for example - services for (1) trading and (2) custody. Example of this include Zodia x 2 (Markets & Custody), Gemini x 2 (Payments and Intergalactic) and Bitpanda x 2 (Custody and Broker).

It is important to note that crypto firms registered in the UK cannot offer their services from the UK into Europe. Those UK companies which are part of a group of companies where one of the group members holds a VASP registration in a Member State can offer service sin that Member State only. Once the VASP achieves MiCA Regulation authorisation in their Member State or in another Member State and has the necessary passporting permissions, they will be able to offer those services across the EEA. If you are unsure of:

Fintech UK is looking to partner with registered / regulated (or soon to be) cryptoasset firms on building out a cryptoasset section on our website. If you are senior executive at a UK registered cryptoasset firm, please contact us here to discuss the proposed project. Also happy to hear from senior executives at businesses which support crypto firms to support the project. See our CRYPTO page for more information If you are crypto firm seeking regulatory advice or director services, please contact CompliReg for assistance at the details appearing here and check out its VASP registration and other authorisation services here. Don't forget to sign up to our Newsletter (we don't spam) by clicking here. We use MailChimp, which means you can unsubscribe whenever you like. ComplyCrypto Depository joins the Fintech UK Registered CryptoAsset Firms Map (Version 11)20/10/2024 Fintech UK is looking to partner with registered / regulated (or soon to be) cryptoasset firms on building out a cryptoasset section on our website. If you are senior executive at a UK registered cryptoasset firm, please contact us here to discuss the proposed project. Also happy to hear from senior executives at businesses which support crypto firms to support the project. See our CRYPTO page for more information If you are crypto firm seeking regulatory advice or director services, please contact CompliReg for assistance at the details appearing here and check out its VASP registration and other authorisation services here. Don't forget to sign up to our Newsletter (we don't spam) by clicking here. We use MailChimp, which means you can unsubscribe whenever you like. Welcome to version 11.0 of Fintech UK's and CompliReg's (a leading provider of fintech consulting services to crypto asset firms) UK FCA registered Cryptoasset Firms Map. We have also partnered with MiCAReady.com which assist digital asset firms meet the requirements under the MICA Regulation. Please get in touch with CompliReg and MiCAReady.com via their websites and give them a follow at Linkedin at https://www.linkedin.com/company/complireg and https://www.linkedin.com/company/mica-ready/ How many registered cryptoasset firms are there in the UK? There are now 45 registered Cryptoasset firms appearing on the Financial Conduct Authority's (FCA) website as at 18th October 2024. This represents an increase in numbers since version 10.0 was issued on 12th September 2024. Version 11 of the Map welcomes the entry of ComplyCrypto Depository which was registered by the UK FCA on 26th September. ComplyCrypto Depository is a partnership between Gentium UK Limited and Complyport Limited. It aims to establish itself as a leader in the UK’s crypto-compliance market, focusing on transparency, regulatory compliance, and innovation. ComplyCrypto Depository is a partnership between Gentium UK Limited and Complyport Limited. It aims to establish itself as a leader in the UK’s crypto-compliance market, focusing on transparency, regulatory compliance, and innovation. Richard Strike, Managing Director of ComplyCrypto, stated, “ComplyCrypto’s mission is to ensure that the growing cryptocurrency marketplace is safer for the economy and society as a whole. By adhering to the stringent requirements set forth by the MLRs, ComplyCrypto ensures its operations remain fully aligned with regulatory obligations related to Anti-money Laundering (AML) and Counter-Terrorist Financing (CTF) measures.” Paul Grainger, Chairman of Complyport and Director of ComplyCrypto, expressed gratitude to the FCA for their “invaluable technical guidance and advice, their professionalism and patience throughout the registration process.” He reaffirmed the commitment of ComplyCrypto’s team to help build a safer crypto-asset marketplace. How many firms have been registered and deregistered by the UK FCA? For those interested in the details, the number of registrations since 2020 until today are as follows:

Total: 48 less 3 de-registrations = 45. These 45 UK FCA registered crypto firms are shown on our Map. How many unregistered crypto firms appear on the FCA register? There remains now 44 'unregistered cryptoasset business’ according to the latest FCA records. There has been now change to the number or names of these 44 firms between 12 September to 18 October 2024. However this is sharp decline since the publication of Version 9.0 Map when there were 69 such unregistered crypto firms. As we continue to Map registered Cryptoasset firms, expect to see certain logos appear more than once as several brands will be registering several Cryptoasset firms for different purposes, such as - for example - services for (1) trading and (2) custody. An example of this is Zodia Markets (UK) Limited and its affiliate Zodia Custody Limited. It is important to note that crypto firms registered in the UK cannot offer their services from the UK into Europe. Those UK companies which are part of a group of companies where one of the group members holds a VASP registration in a Member State can offer service sin that Member State only. Once the VASP achieves MiCA Regulation authorisation in their Member State or in another Member State and has the necessary passporting permissions, they will be able to offer those services across the EEA. If you are unsure of:

Linkedin Posts: https://www.linkedin.com/posts/peteroakes_cryptoasset-cryptocompliance-fintechuk-activity-7254485024501067777-bvhd Fintech UK is looking to partner with registered / regulated (or soon to be) cryptoasset firms on building out a cryptoasset section on our website. If you are senior executive at a UK registered cryptoasset firm, please contact us here to discuss the proposed project. Also happy to hear from senior executives at businesses which support crypto firms to support the project. See our CRYPTO page for more information

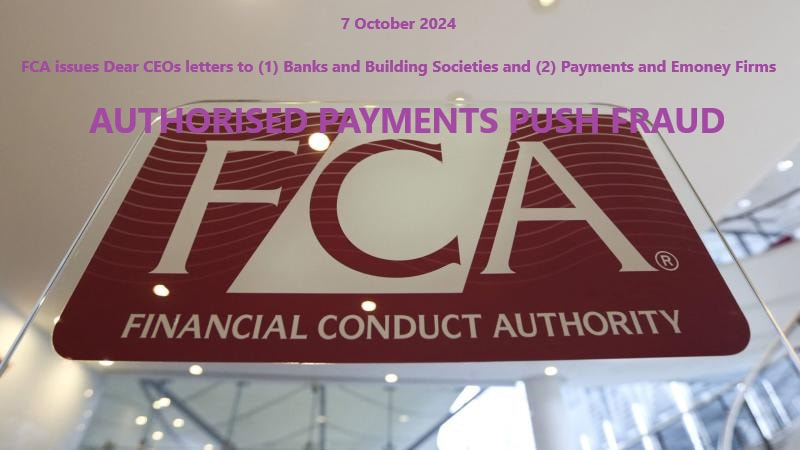

If you are crypto firm seeking regulatory advice or director services, please contact CompliReg for assistance at the details appearing here and check out its VASP registration and other authorisation services here. Don't forget to sign up to our Newsletter (we don't spam) by clicking here. We use MailChimp, which means you can unsubscribe whenever you like. FCA Letter to Payments and Emoney Firms (7 October 2024) (from Matthew Long, Director, Payments & Digital Asset; Supervision, Policy & Competition) FCA Letter to Banks and Building Societies (7 October 2024) (from Emad Aladhal, Director, Retail Banking Supervision, Policy & Competition). Started as a Linkedin Post by Peter Oakes, Founder of Fintech UK. https://www.linkedin.com/feed/update/urn:li:activity:7249312812194230272/ Summary of the Banks and Building Society Dear CEO Letter: The letter outlines the FCA's expectations regarding Authorised Push Payment (APP) fraud reimbursement and highlights several key points:

Overall, the letter underscores the regulatory framework aimed at enhancing consumer protection against APP fraud and the responsibilities of PSPs in this context. Summary of the Emoney & Payments Dear CEO Letter: The letter outlines the FCA's expectations for Payment Service Providers (PSPs) regarding Authorised Push Payment (APP) fraud reimbursement. Key points include:

What is the difference between the two Dear CEO Letters?

The letter issued to Payments and Emoney Firms includes: "Capital and liquidity PSPs should recognise and manage their potential liability and the impact this may have on their capital and liquidity. We expect PSPs to review and adjust their business models and transactions to mitigate against any risk of prudential impact that may result from potential APP fraud reimbursement liabilities." The UK FCA seems far less concerned about the introduction of the new APP Fraud regime on banks/building societies than it is for payments and emoney firms. ABEX Capital UK Limited assumes crypto registration of Rubicon Digital in the UK (Version 10.0)12/9/2024 Fintech UK is looking to partner with registered / regulated (or soon to be) cryptoasset firms on building out a cryptoasset section on our website. If you are senior executive at a UK registered cryptoasset firm, please contact us here to discuss the proposed project. Also happy to hear from senior executives at businesses which support crypto firms to support the project. See our CRYPTO page for more information If you are are crypto firm seeking regulatory advice or director services, please contact CompliReg for assistance at the details appearing here and check out its VASP registration and other authorisation services here. Don't forget to sign up to our Newsletter (we don't spam) by clicking here. We use MailChimp, which means you can unsubscribe whenever you like. Welcome to the version 10.0 of Fintech UK's and CompliReg's (a leading provider of fintech consulting services to crypto asset firms) UK FCA registered Cryptoasset Firms Map. How many registered cryptoasset firms are there in the UK? There remains 44 registered Cryptoasset firms appearing on the Financial Conduct Authority's (FCA) website as at 12th September 2024. There has been now increase in numbers since version 9.0 was issued on 27th February 2024. Version 10 of the Map is issued to recognised that ABEC Capital UK Limited now operates under the registration originally issued to Rubicon Digital UK Limited back 7 April 2022. On 28th August 2024, ABEX Capital UK Limited announced that it became authorised as a cryptobusiness in the UK. Companies House records for ABEX record a change of name on 27 August 2024 from Rubicon. ABEX says: "This strategic move enables ABEX to expand its services beyond providing innovative solutions based on advanced proprietary execution algorithms, smart order routing, and ultra-low latency, and high frequency trading infrastructure. ABEX Capital UK Limited which will operate under the supervision of the FCA, one of the world’s most trusted financial regulators, will allow ABEX to broaden its institutional client service offerings to include agency algorithms on a matched principal basis." Erkan Kaya, CEO and Co-Founder of ABEX, stated: “Owning an FCA registered entity is an exciting milestone for ABEX, reinforcing our commitment to delivering institutional-grade, best execution services for digital assets under regulatory supervision. This status aligns seamlessly with our strategic vision of not only servicing our institutional clients in a transparent and fully auditable fashion but doing so to standards which meet the requirements of a major regulator.”. ABEX, is a leading provider of agency algorithms and ultra-low latency, high frequency trading infrastructure for digital assets. How many unregistered crypto firms appear on the FCA register?

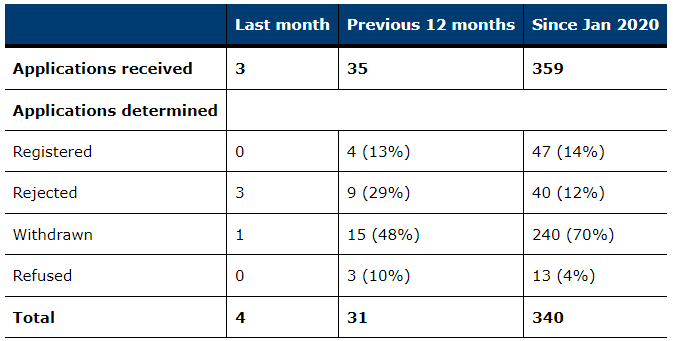

There are now, as at 12 September 2024, 44 'unregistered cryptoasset firms according to the latest FCA records. This is sharp decline since the time we published the Version 9.0 Map when there were 69. As we continue to Map registered Cryptoasset firms, expect to see certain logos appear more than once as several brands will be registering several Cryptoasset firms for different purposes, such as - for example - services for (1) trading and (2) custody. An example of this is in fact Zodia. While Zodia Markets (UK) Limited was registered on 27 July 2022, its affiliate Zodia Custody Limited was registered effective 15 July 2021. The FCA has been the anti-money laundering and counter-terrorist financing (AML/CTF) supervisor of UK cryptoasset businesses since 10 January 2020. See a summary of the applications for registration that it has received and the outcomes of the applications that have been determined, as at 1 September 2024. The FCA says that "We have rejected submissions that didn’t include key components necessary for us to carry out an assessment, or the poor quality of key components meant the submission was invalid."

Note: The table does not include information on any appeals following FCA decisions to refuse applications. In its Annual Report for 2023/24, the FCA stated that "Over 87% of Crypto registrations were withdrawn, rejected or refused for weak money laundering controls." In the same report the FCA stated it the number of firms who had their authorisations cancelled, doubled from 2022/23 to 1,261. With respect to authorisation efficiency levels, the FCA stated that 98% of authorisation cases were assessed within statutory deadlines in the reporting period, up from 89% in Q1 of 2022/23 Source: https://www.fca.org.uk/firms/cryptoassets-aml-ctf-regime/feedback-good-poor-applications https://www.fca.org.uk/publication/annual-reports/annual-report-2023-24.pdf Revolut has secured a UK banking licence – with “restrictions” – more than three years after Britain’s most valuable fintech firm lodged its application with regulators. The Bank of England / Prudential Regulatory Authority recorded the legal entity Revolut NewCo UK Ltd as a bank in its 'As at 1 August 2024' update. The UK Financial Conduct Authority register shows that Revolut NewCo UK was registered on 25 July 2024. The Revolut entity has been assigned reference number 981170 It is a milestone for the company, and will help pave the way for an eventual stock market listing, but it may still be some time before it can hold its customers’ deposits. Tentative approval from the Bank of England means Revolut is in the mobilisation stage, where it will build up its banking operations. The London-headquartered firm has waited years to get to this stage, having lodged its application for a UK banking licence in 2021. The challenge, in part, was convincing regulators that Revolut had addressed a number of accounting issues and EU regulatory breaches, as well as reputational concerns, including an over-aggressive corporate culture. The UK’s Financial Conduct Authority also reportedly investigated the business in 2016 after a whistleblower claimed it was failing to conduct adequate money-laundering checks or properly flag suspect payments. That investigation was closed in 2017. At the start of July this year, Nikolay Storonsky, Revolut’s CEO and co-founder, told CNBC that the company is feeling confident about securing its British bank license, after overcoming some key hurdles in its more than three-year-long journey toward gaining approval from regulators. At the time he said “Hopefully, sooner or later, we’ll get it,”. Regulators are “still working on it,” he added, but so far haven’t raised any outstanding concerns with the fintech. CNBC reported that one key issue the company faced was with its share structure being inconsistent with the rulebook of the Prudential Regulation Authority, which is the regulatory body for the financial services industry that sits under the Bank of England. Revolut has multiple classes of shares and some of those share classes previously had preferential rights attached. One conditions set by the Bank of England for granting Revolut its U.K. banking license, was to collapse its six classes of shares into ordinary shares. Revolut has since resolved this, with the company striking a deal with Japanese tech investor SoftBank to transfer its shares in the firm to a unified class, relinquishing preferential rights, according to a person familiar with the matter. News of the resolution with SoftBank was first reported by the Financial Times. Who is in charge of the UK bank? As at the date of its authorisation the following people are recorded by the UK FCA as being involved in the activities of Revolut NewCo UK:

Further reading: https://www.theguardian.com/business/article/2024/jul/25/revolut-receives-uk-banking-licence-after-three-year-wait https://www.cnbc.com/2024/07/02/revolut-boss-confident-on-uk-bank-license-approval-after-record-profit.html Revolut is exploring plans to monetise customer data through sharing it with advertising partners, as the fintech seeks new sources of revenue while its application for a UK banking licence remains in limbo.

“We could become a media [business] . . . a place where you have an audience and data about the audience and you monetise this,” Revolut’s head of growth. Revolut’s push to generate a bigger slice of earnings from advertising comes as investor hype surrounding the fintech sector has waned and its application for a UK banking licence appears to have stalled. Revolut secured a $33bn valuation in a funding round led by SoftBank in 2021. However, investors Molten Ventures and Schroders have since adjusted their implied internal valuations for the start-up, with Schroders putting it as low as $18bn at the end of 2022, before revising it up to $26bn as of the end of December 2023. It has been more than three years since the London-based fintech applied for a UK banking licence. They are typically granted within a year, UK regulatory guidance says. Securing a licence is crucial to Revolut’s ambitions to roll out lending on a wider scale in its home market and boost its profitability. https://www.ft.com/content/21c34ad2-c267-4810-a4bf-8908a3599d72 Boards are being forced to think about finding future leaders earlier as shareholders demand greater insighOne often-cited study* shows 40 per cent of CEO transitions end in failure within 18 months. Tenure in the post is also declining**.

Boards must then deal appropriately with the losers — either find incentives to prevent them from leaving or ensure they exit without animosity. Last year, Morgan Stanley chose to award the same bonus to three candidates even though only one took the top job. The bank also gave senior roles to the two that lost out, creating a more distributed leadership model. * https://www.researchgate.net/publication/8008180_Ending_the_CEO_Succession_Crisis ** https://corpgov.law.harvard.edu/2023/08/04/ceo-tenure-rates-2/ Source: https://www.ft.com/content/3ec199e7-fc04-45c4-987b-2b2ac9e0ed6e |

AuthorFintech UK and Peter Oakes Archives

July 2025

Categories

All

|