If you are are crypto firm seeking regulatory advice or director services, please contact CompliReg for assistance at the details appearing here and check out its VASP registration and other authorisation services here.

Hope you like the Map (Version 6.0)!

Don't forget to sign up to our Newsletter (we don't spam) by clicking here. We use MailChimp, which means you can unsubscribe whenever you like.

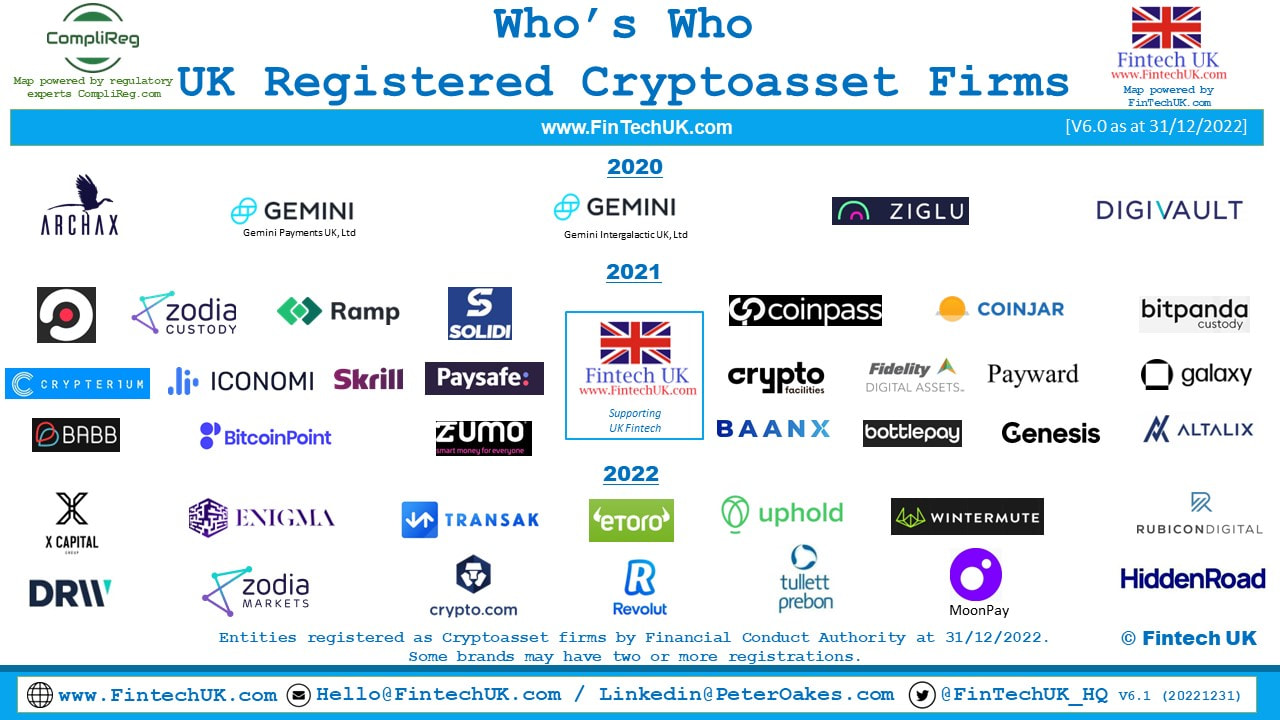

Welcome to the version 6.0 of Fintech UK's and CompliReg's (a leading provider of fintech consulting services to crypto asset firms) UK FCA registered Cryptoasset Firms Map.

There are now 41 registered Cryptoasset firms appearing on the Financial Conduct Authority's (FCA) website as at Saturday 31st December 2022. Joining Version 6.0 are three new entrants - Tullett Preborn (Europe) Ltd, MoonPay (UK) Ltd and Hidden Road Partners CIV UK Ltd. The FCA register records their registrations effective 21st November, 9th December and 20 December 2022, respectively.

As we continue to Map registered Cryptoasset firms, expect to see certain logos appear more than once as several brands will be registering several Cryptoasset firms for different purposes, such as - for example - services for (1) trading and (2) custody. An example of this is in fact Zodia. While Zodia Markets (UK) Limited was registered on 27 July 2022, its affiliate Zodia Custody Limited was registered effective 15 July 2021.

At the time we released Version 1, there were 218 (thereabouts) unregistered cryptoasset business listed on the UK FCA's website that appear, to the FCA, to be carrying on cryptoasset activity, that are not registered with the FCA for anti-money laundering purposes. As of today (01 April 2023), that number has decreased to 82.

The firms thus far registered by the FCA include:

2020: Archax Ltd, Gemini Europe Ltd, Gemini Europe Services Ltd, Ziglu Limited, Digivault Limited,

2021: Fibermode Limited, Zodia Custody Limited, Ramp Swaps Limited, Solidi Ltd, Coinpass Limited, CoinJar UK Limited, Trustology Limited, Commercial Rapid Payment Technologies Limited, Iconomi Ltd, Skrill Limited, Paysafe Financial Services Limited, Crypto Facilities Ltd, Fidelity Digital Assets LTD, Payward Limited, Galaxy Digital UK Limited, BABB Platform Ltd, BCP Technologies Limited, Zumo Financial Services Limited, Baanx.com Ltd, Bottlepay Ltd, Genesis Custody Limited, Altalix Ltd,

2022: X Capital Group Limited, Enigma Securities Ltd, Light Technology Limited, eToro (UK) Ltd, Uphold Europe Limited, Wintermute Trading LTD, Rubicon Digital UK Limited, DRW Global Markets Ltd, Zodia Markets (UK) Limited, Foris DAX UK Ltd (aka Crypto.com), Revolut Ltd*, Tullett Preborn (Europe) Ltd, MoonPay (UK) Ltd and Hidden Road Partners CIV UK Ltd.

* Revolut group still has not achieved its much talked about ambition of securing a bank authorisation in the UK.

We are looking forward to seeing how many more will be registered during 2023. Thus far, there have been no registrations in 2023.

The post accompanying Version 6 appears at:

- CompliReg: https://complireg.com/blogs--insights/tullett-prebon-moonpay-and-hiddenroad-join-fintech-uks-whos-who-of-uk-registered-cryptoasset-map-version-60-saturday-1st-april-2023

- Linkedin: https://www.linkedin.com/posts/peteroakes_cryptoasset-cryptomap-cryptofirms-activity-7048281954894368768-VbNC?utm_source=share&utm_medium=member_desktop

Further Reading:

Version 1 of the Map and the Blog of 20 December 2021 - located here

Version 2 of the Map and the Blog of 18 July 2022 - located here

Version 3 of the Map and the Blog of 28 July 2022 - located here

Version 4 of the Map and the Blog of 20 September 2022 - located here

Version 5 of the Map and the Blog of 26 September 2022 - located here

List of Unregistered Cryptoasset Businesses as of today - located here

Postscript - Letter issued by UK FCA on 5 April 2023 to UK and overseas cryptoasset firms on financial promotion rules - located here