The UK continues to be ranked as one of the most fintech-friendly countries in the world.

The sector is home to many of the world’s largest fintech companies and is comprised of more than 1,600 firms – a number projected to double by 2030. It is well reported that the UK is a top financial technology hub, but why?

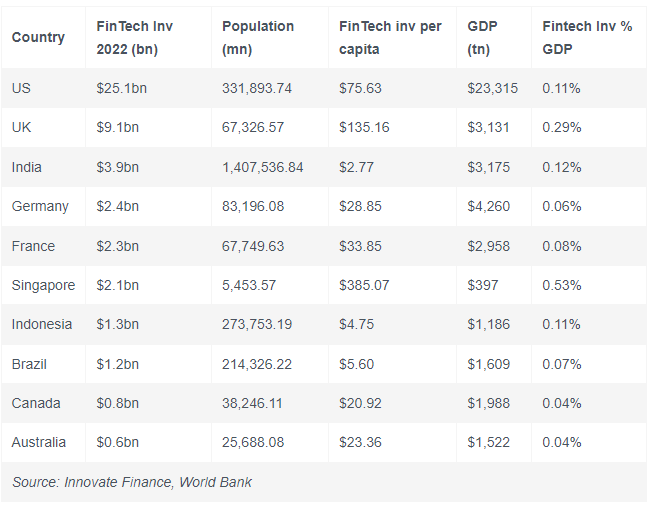

In terms of fintech investment per capita and as a percentage of GDP, the UK is second only to Singapore.

This comment by the author, Jonathan Warren in the FT Adviser, sums it up:

"It is no coincidence that Singapore and the UK, where fintech investment is highest as a percentage of GDP, have globally respected regulatory frameworks, good infrastructure, and political, economic, legal, and social stability."

Further, the UK is a global fintech hub, with extensive financial services experience, technological talent and progressive regulation.

The UK fintech sector is the top-ranking investment destination in Europe with £3 billion venture capital attracted in 2020. It accounts for more deals and capital invested than Germany, Sweden, France, Switzerland and the Netherlands combined and ranks second globally only behind the US. The UK also has access to world-class talent and a progressive approach to regulation to encourage fintech innovation. [Postscript 15 February 2023 - despite investment in UK fintech falling in 2022, British fintechs attracted more funding than their counterparts in the rest of EMEA combined.]

The UK’s finance and tech sectors and a world-class university system provide a large pool of talent for fintech. Around 76,500 people across the UK work in the industry with this set to grow to 105,500 by 2030. The Global Talent Visa in digital technology is set to attract and fast-track digital tech talent from around the world.

UK fintech sector benefits from a supportive regulatory system. The Financial Conduct Authority, the Prudential Regulation Authority and the Bank of England are heavily involved in build a competitive and innovation-friendly [and I hasten to add a resilient and robust] business environment. This helps companies grow and develop their fintech business in the UK.

The UK has entered 5 fintech bridge agreements with other fintech hubs including Singapore, South Korea, China, Hong Kong and Australia. These bespoke agreements create valuable opportunities for expansion and collaboration by reducing barriers to international markets.

Some of the opportunities in FintechUK are:

- Payment technology (Paytech)

- Wealthtech

- Credit and lendingtech

- Digital banking

- Distributed Ledger Tech (DLT)

- Digital Assets

- Digital / Crypto Currencies

- Proposed UK Digital Pound

Read more at:

- https://www.armstrongteasdale.com/fintech/

- https://www.linkedin.com/posts/peteroakes_fintech-irishfintech-fintechbridge-activity-7034065608975511552-SGz1

- https://www.ftadviser.com/investments/2023/01/30/why-is-the-uk-so-successful-in-fintech/

- https://www.great.gov.uk/international/content/investment/sectors/fintech/

Posted by Peter Oakes FintechUK.com