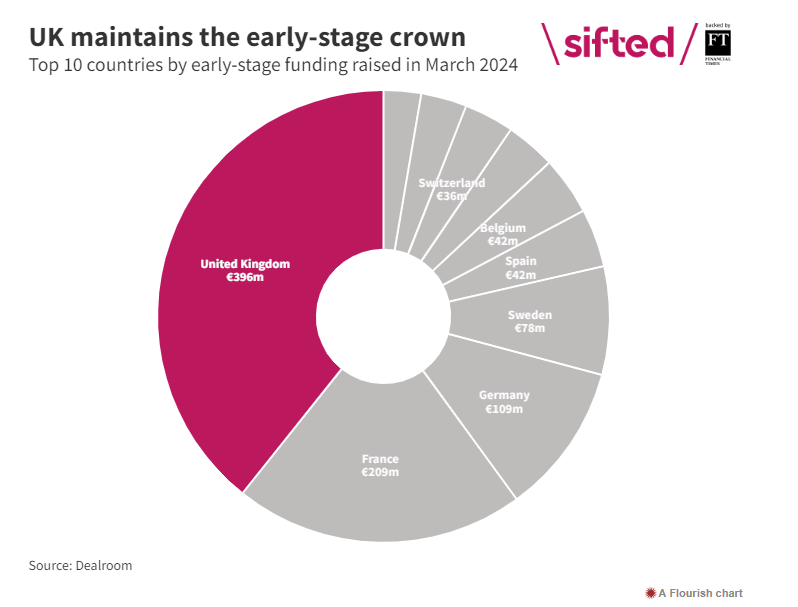

Trade body Innovate Finance's "Unicorn Council", which includes the CEOs of Monzo, Revolut's UK arm and ClearBank, set out policy recommendations on Monday that it said would help the UK maintain its position as a fintech hub.

Global venture capital investments fell to a near five-year low in the first three months of 2024, according to data from PitchBook, as high interest rates dampened risk appetite.

Fintech companies in the UK say there is not enough investment coming from UK-based investors in particular.

"There is a well-documented problem with capital supply in both the UK listed markets and private Growth Capital," the group's statement said.

“All of the investment across our biggest fintechs (is) all overseas. Where are the UK pension funds? Why isn’t that growth actually going into the pockets of the UK?" added ClearBank CEO Charles McManus, speaking at the Innovate Finance Global Summit (IFGS) conference held in London on Monday.

Innovate Finance CEO Janine Hirt told Reuters that there needs to be more domestic investment in fintech.

Source: https://www.reuters.com/world/uk/uk-fintechs-ask-government-help-ease-capital-shortages-2024-04-15/