Highlights from the announcement include:

- Total capital invested in FinTech globally reaches $59bn – flat year-on-year

- UK FinTech sector continues to grow with investment reaching $9.1bn – a 24% year-on-year increase from 2021

- UK remains second globally in FinTech investment, behind the US, and the top destination of Europe

- Capital was spread across 3,045 deals – which is slightly fewer than 2021 which saw 3,401 deals in the first half of the year

- Global slowdown comes with some exceptions including the UK which recorded a 24% year-on-year increase from 2021

- Value of the top 5 biggest deals globally in the first half of 2022 was $5.0 bn, with Checkout.com, one of the top five from the UK. The largest deals from highest to lowest were for FNZ ($1.4bn), Trade Republic ($1.2 bn), Checkout.com ($1bn), Ramp ($748m) and Coda Payments ($690m)

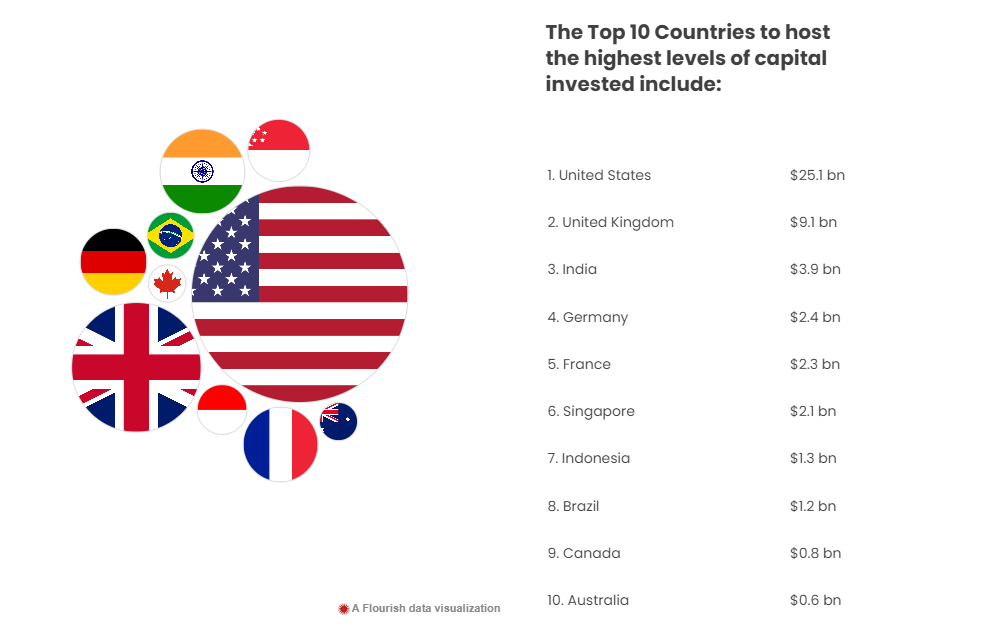

- US received the most investment in the first half of 2022, bringing in $25bn in FinTech capital, with the UK firmly in second place with $9.1bn, rounded off by India ($3.9bn), Germany ($2.4bn) and France ($2.3bn)

- Some countries have seen notable drops in investment in the first half of 2022 including Mexico, Netherlands, South Korea, and China, all falling down the global rankings.

Commenting on the findings, Janine Hirt, CEO of Innovate Finance the industry body, said:

“It is fantastic to see that UK FinTechs are continuing to secure outstanding levels of investment – this is a testament to the strength of our ecosystem, including our innovative entrepreneurs and founders, strong and diverse talent pool, and a supportive government and regulatory framework.

“It is critical that we now keep up this momentum. The UK is currently receiving more investment in FinTech than all of Europe, second only in the world to the US. We must continue to work together – industry, government and regulators – to build on this leadership and ensure the UK remains the best place in the world to start, build and scale a FinTech business. This will positively impact not only the financial services sector but the entire population of the UK as a whole who will benefit from new, innovative, and more effective products that drive greater financial wellness.”

Further Reading:

- Innovate Finance Press Release

- Innovate Finance Full Analysis