The UK's Sky News reports that the UK-based bank is among a crop of new investors joining a funding round for Copper, which counts former chancellor Lord Hammond among its advisers. The news agency reports that "City sources said Barclays was expected to invest a relatively modest sum in the millions of dollars as part of the round." and the fundraising is expected to be finalised within days.

Copper's strapline is that it provides an institutional gateway to digital asset investing through a trading system without moving assets to exchanges, eliminating the risk of hacked, frozen, or misappropriated assets.

It was reported earlier this year that Copper was targeting a valuation of at least $3bn in its latest capital raise but has since scaled that back, reflecting the growing crisis in the wider crypto-assets sector.

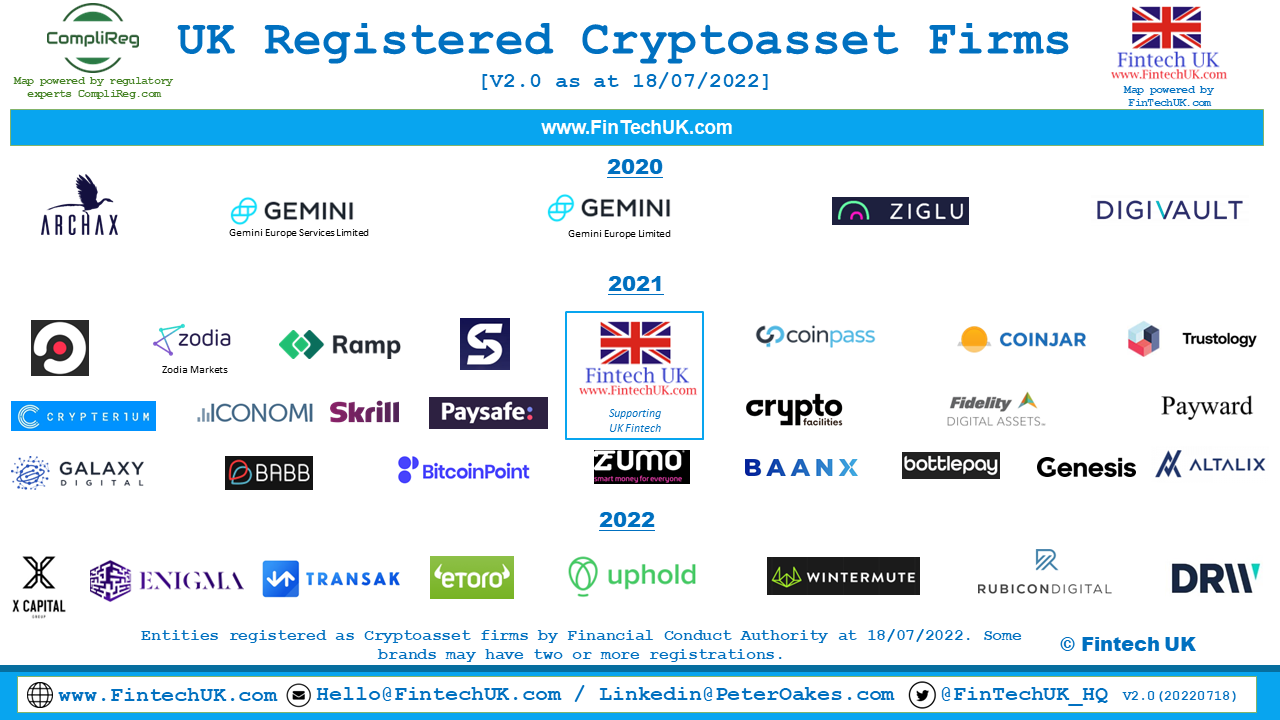

Apparently Copper has also grown frustrated with the approach of UK financial regulators, prompting it to establish a hub in Switzerland instead. That explains why Copper doesn't appear on Version 2 of Fintech UK's registered cryptoasset Map released last week.

Barclays and Copper declined to comment.