Released yesterday, A new Consumer Duty Feedback to CP21/36 and final rules Policy Statement PS22/9 27 July 2022. See link to FCA page at end of this blog.

Final rules and guidance in UK for a new Consumer Duty (‘the Duty’) that will set higher expectations for the standard of care firms give consumers.

UK firms need to understand their customers’ needs and to have the flexibility to support them with certainty of the FCA's expectations, so they get good outcomes.

Under the Duty, firms will need to assess and evidence the extent to which and how they are acting to deliver good outcomes. Combined with the FCA's more data‑led approach, this should enable the FCA to more quickly identify practices that negatively affect those outcomes and to intervene before practices become widespread

Who this affects?

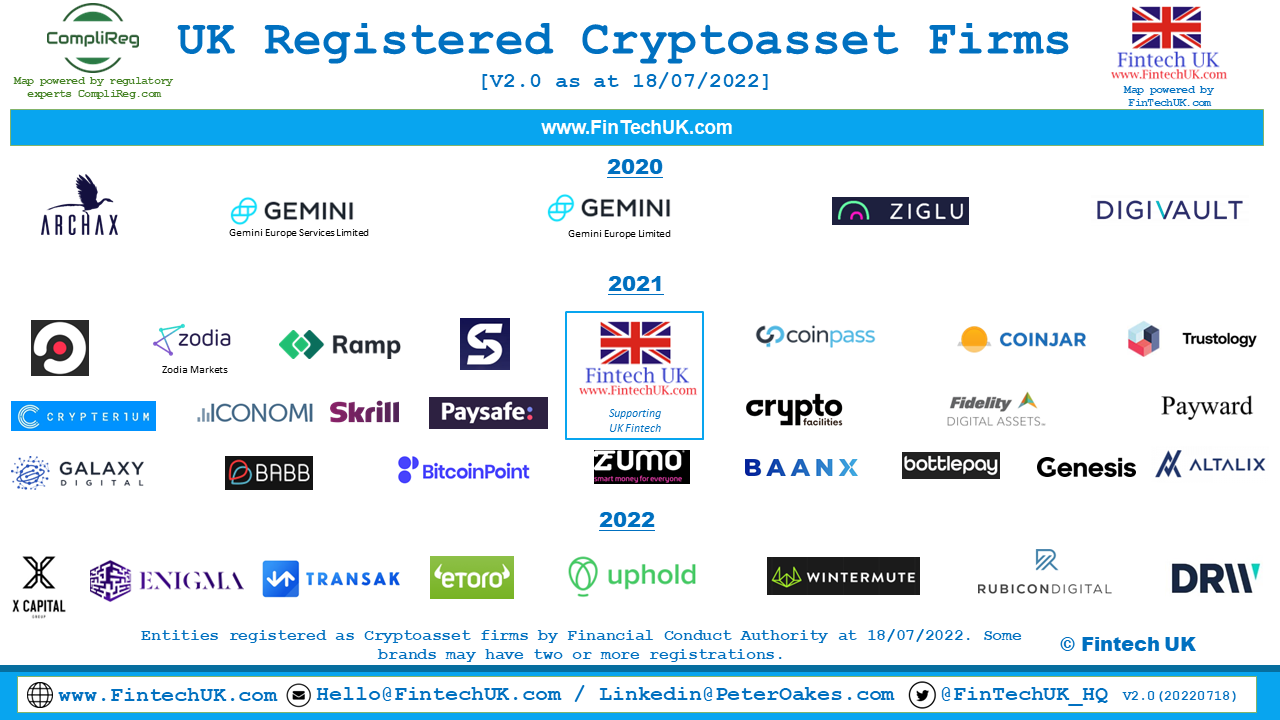

- regulated firms, including those in the e‑money and payments sector

- consumer organisations and individual consumers

- industry groups/trade bodies

- policy makers and regulatory bodies

- industry experts and commentators

- academics and think tanks

What is changing?

Introducing rules comprising:

- A new Consumer Principle that requires firms to act to deliver good outcomes for retail customers

- Cross‑cutting rules providing greater clarity on FCA expectations under the new Principle and helping firms interpret the four outcomes (see below). The cross‑cutting rules require firms to:

- act in good faith

- avoid causing foreseeable harm

- enable and support retail customers to pursue their financial objectives

Rules relating to four outcomes the FCA wants to see under the Duty.

These represent key elements of the firm‑consumer relationship which are instrumental in helping to drive good outcomes for customers.

These outcomes relate to:

- products and services

- price and value

- consumer understanding

- consumer support

The rules require firms to consider the needs, characteristics and objectives of their customers – including those with characteristics of vulnerability – and how they behave, at every stage of the customer journey. As well as acting to deliver good customer outcomes, firms will need to understand and evidence whether those outcomes are being met.

Implementation timetable:

Firms will need to apply the Duty to new and existing products and services that are open to sale (or renewal) from 31 July 2023. The FCA has given firms longer, until 31 July 2024, to apply the Duty to products and services held in closed books.)

Click here for Consumer Duty Feedback to CP21/36 and final rules Policy Statement